Clayton County, Georgia, with an estimated 2025 population of 298,102 and a slight 0.45% decline since 2020, is experiencing ongoing demographic shifts and property tax challenges.

Unlike the rapid population growth in neighboring Atlanta counties, Clayton County faces unique challenges where the residential market is flattening, but the commercial real estate market jumped dramatically in 2025.

To better understand what to expect for the 2025 tax year, we need to examine the current market values in Clayton County and how they compare to last year.

Key Findings:

Clayton County's Residential Market Shows Mixed Signals

Clayton’s residential market shows modest growth, with median market values increasing by 1.37% YoY.

The median market value of residential properties under $250K, which comprises 75% of Clayton County's total, increased by 3.22%.

Properties in the $250K-$500K range saw slight declines with a median change of -0.32%

What's Happening Across Residential Market Value Bands

Clayton County's residential property market reveals a nuanced pattern where different price segments are experiencing vastly different trends. Based on our analysis of 2024 to 2025 median market value changes:

Market Value Band | Median MV YoY % Change | Properties in Band |

|---|---|---|

$0-250K | 3.22% | 50,212 |

$250K-500K | -0.32% | 24,405 |

$500K-750K | 0.68% | 356 |

$750K-1M | 0.77% | 83 |

$1M-1.5M | 0.86% | 60 |

$1.5M-3M | 0.95% | 28 |

$5M+ | 24.84% | 3 |

The data reveals that entry-level homes under $250,000 — representing the vast majority of Clayton County properties at over 50,000 units — hold their value better than mid-range properties.

Properties from $250,000 to $500,000, which comprise about a quarter of all homes, experienced a slight median price decline of 0.32%. Meanwhile, the mid-range properties between $500,000 and $3 million had minimal growth of 0.68% to 0.95%.

The number of ultra-luxury properties over $5 million increased dramatically by nearly 25%. However, this data point should be viewed cautiously, as only three properties are in this category.

Commercial Real Estate: A Story of Dramatic Growth

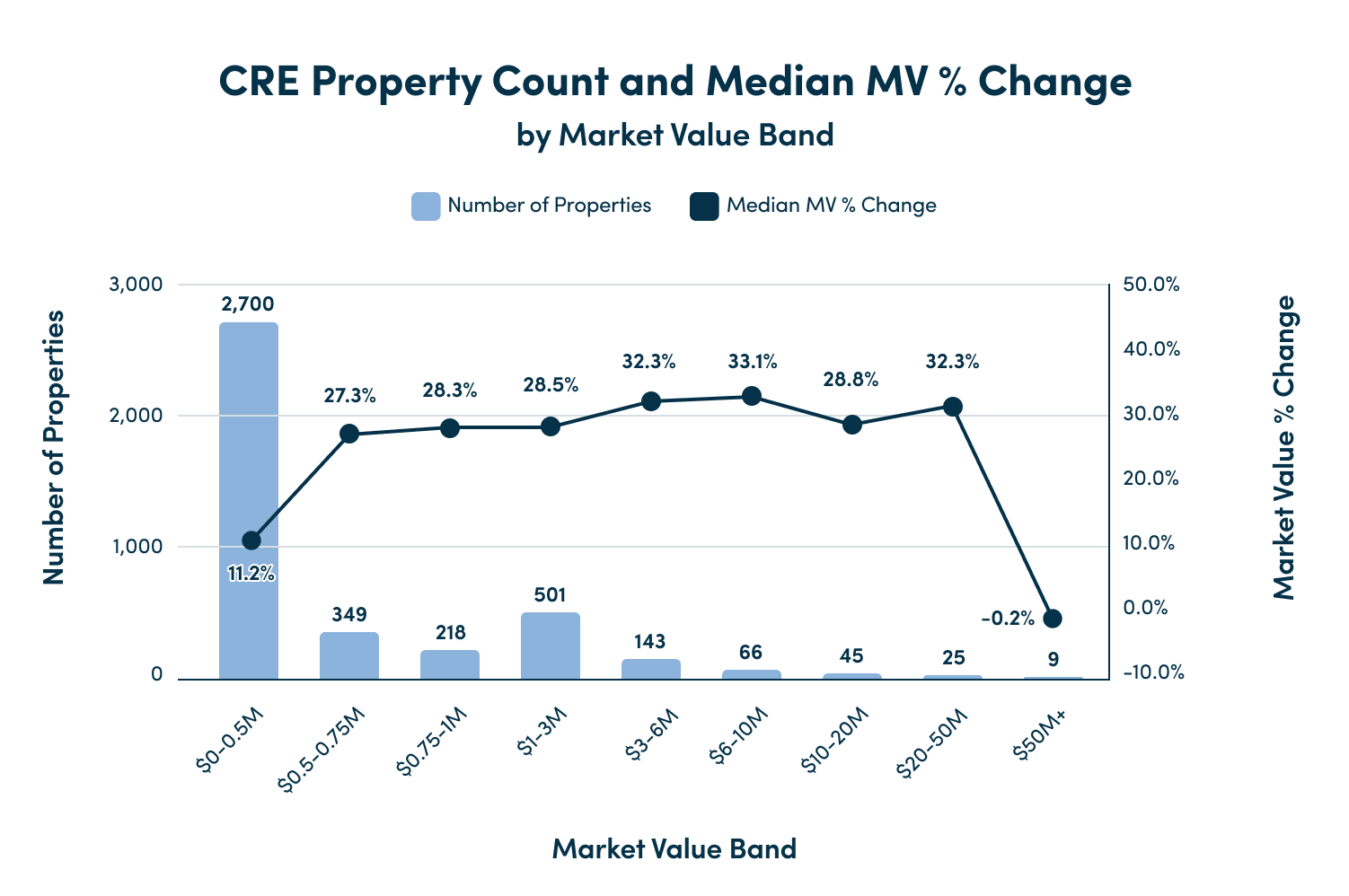

While residential properties show mixed results, Clayton County's commercial real estate sector tells a different story: explosive growth across nearly all segments, making it ripe for a Georgia property tax appeal.

Overall Commercial Market

Key Takeaways:

The median market value YoY increase for all commercial properties was 21.6%.

The vertical with the slowest growth was multi-family, with a 9.32% increase, while lodging and industrial experienced the most significant growth, at nearly 32% each.

Properties under $500,000 — which make up two-thirds of all Clayton commercial properties — increased by only 11.2%, much less than other market value bands.

Commercial Property Analysis by Vertical

Office Properties

Office properties experienced robust growth with median increases of 26.3% to 34.81% across all market value bands.

Properties under $500K (288 units) saw median gains of 28.8%, while more premium office spaces ($1M-$3M) jumped 30.1%.

Industrial Properties

Industrial and lodging properties led all sectors with median increases of 32%, making it ideal for industrial property owners to appeal their commercial property taxes.

Nearly half of industrial properties are worth under $500,000, and the median market value increased by 30.1%.

Retail Properties

Retail has the largest commercial segment by number of units (1,399) and had consistent gains of 27% to 33% across most segments.

The 634 retail properties (46% of all retail properties) worth under $500,000 had a median market value increase of 29%.

Multi-Family Properties

Multi-family properties showed slower growth than any other vertical, with a median increase of 9.3%.

Properties worth between $1 million and $20 million had more growth, with a market value change of 19.9%.

The 16 multi-family properties worth over $20 million had a 15.4% decrease YoY.

Lodging Properties

Clayton County has only 111 lodging properties; however, their median market value increased by 32%.

The 40 hotel and resort properties worth over $1 million experienced the most growth, with a 34% year-over-year increase.

Why Clayton County Property Owners Should Appeal Their 2025 Tax Assessments

Understanding Georgia's Property Tax System

Georgia's property tax system provides several mechanisms that savvy property owners can use to their advantage:

The Assessment Process: All property is valued based on its condition and use as of January 1 each year for ad valorem taxes.

The Appeal Window: Property owners have a limited time to act. Suppose a property owner wishes to appeal the fair market value on the notice of assessment. In that case, the appeal must be sent to the board of tax assessors and postmarked no later than 45 days from the mailing date of the notice of assessment, which is often late April through late June.

The Power of the 299(c) Freeze

One of the most powerful tools available to Georgia property owners is the 299(c) property tax provision, which can provide significant long-term tax relief.

The 299c lock is implemented when a property owner takes their appeal to the Board of Equalization (BOE) or a higher level, and their value is reduced. When this happens, the deciding agency "freezes" the property's value at this reduced value for three years.

Key Reasons to Appeal in 2025

1. Market Volatility Creates Opportunities: While home values are seeing a more modest climb of about 1.4% in 2025, commercial properties have jumped significantly, around 21.6%. These changes mean it’s a good time to appeal your property assessment, especially since a successful appeal can freeze your property value for three years.

2. High Effective Tax Rate: Clayton County's effective median property tax rate is slightly higher than the national average (1.44% compared to 1.02%), which magnifies the importance of ensuring accurate assessments.

3. Long-Term Savings Through 299(c): Successfully appealing your assessment not only reduces your current tax bill, but it also locks in savings for three years, providing budget certainty in uncertain times.

Appeal With Experts

Navigate Georgia's complex property tax appeal process with Ownwell. We’ll analyze your property's assessment against current market data, prepare a comprehensive appeal package, and represent you through the entire appeal process. Don't overpay! Let us help you keep more of your money.

With Clayton County's bifurcated market — flattening residential values and soaring commercial assessments — professional expertise is more critical than ever to ensure you're not overpaying.

Let Ownwell's experts help you keep more of your hard-earned money where it belongs: in your pocket. See how much you're overpaying in property taxes.