Georgia homeowners are navigating a complex landscape of property tax assessments and new state legislation. Most are uninformed of their legal rights or state laws that significantly impact their property tax bills.

Our comprehensive survey of over 850 Georgia homeowners reveals widespread confusion about property tax appeals and the effects of recently passed state laws on residents’ financial obligations.

Key Takeaways:

Assessment skepticism: Over half (52%) of Georgia homeowners believe their property is overvalued for tax purposes.

Financial strain: 94% are somewhat or very concerned about significant increases in their property tax bills, with two-thirds (67%) saying this year’s tax bills were higher than they’d budgeted for.

Appeal reluctance: Over 8 in 10 Georgia homeowners have never appealed their property tax assessment, with 57% unaware they have the right to do so.

Legislative awareness gap:

57% of Georgia homeowners are unfamiliar with the three-year 299c property tax freeze provision.

And half have never heard of the ‘floating homestead exemption’ enacted this year.

Property Values Under Scrutiny

Our survey reveals a crisis of confidence in Georgia's property assessment system. More than half (52%) of homeowners were shocked by their last property tax assessment, signaling concern about rising property values and their impact on tax bills.

Also noteworthy, Georgia homeowners are increasingly skeptical of their property assessments:

This skepticism is well-founded. In Georgia, the median home value has increased by 3.9% from June 2022 to June 2025, leading to corresponding tax increases that often outpace homeowners' budgets.

Tax Bills Exceed Expectations, Creating Budget Concerns

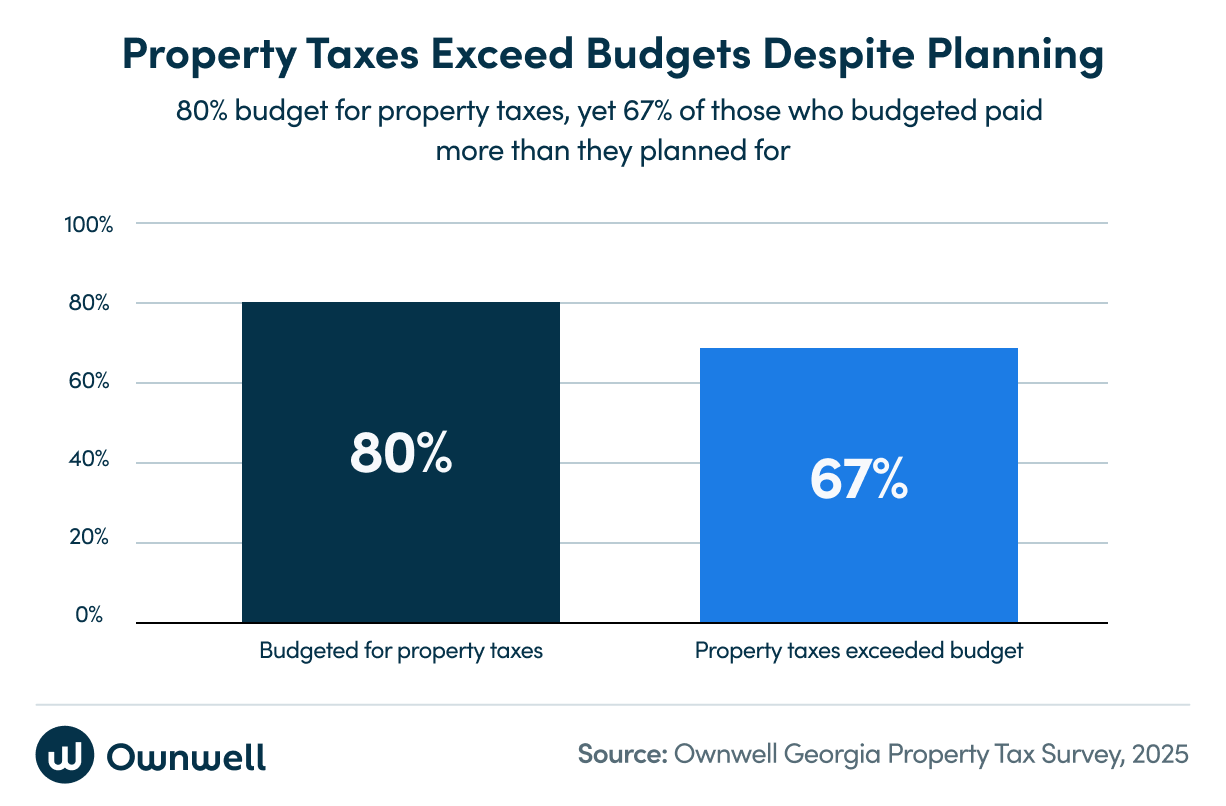

Many Georgia families find it challenging to plan for property taxes. While 80% of homeowners budget for property taxes as part of their annual homeownership expenses, they often face difficulties:

Two-thirds of those who budget for property taxes still found their bill exceeded what they planned for.

94% are concerned about significant increases in annual property tax bills (35% are "very concerned").

This disconnect between budgeting and reality suggests property tax increases are outpacing homeowners' ability to plan and pay, creating financial stress across the state.

The Appeal Paradox: High Concern, Limited Knowledge, and Low Action

Similar to our national homeowner survey findings, despite widespread concern about property taxes, multiple barriers are preventing Georgia homeowners from taking action:

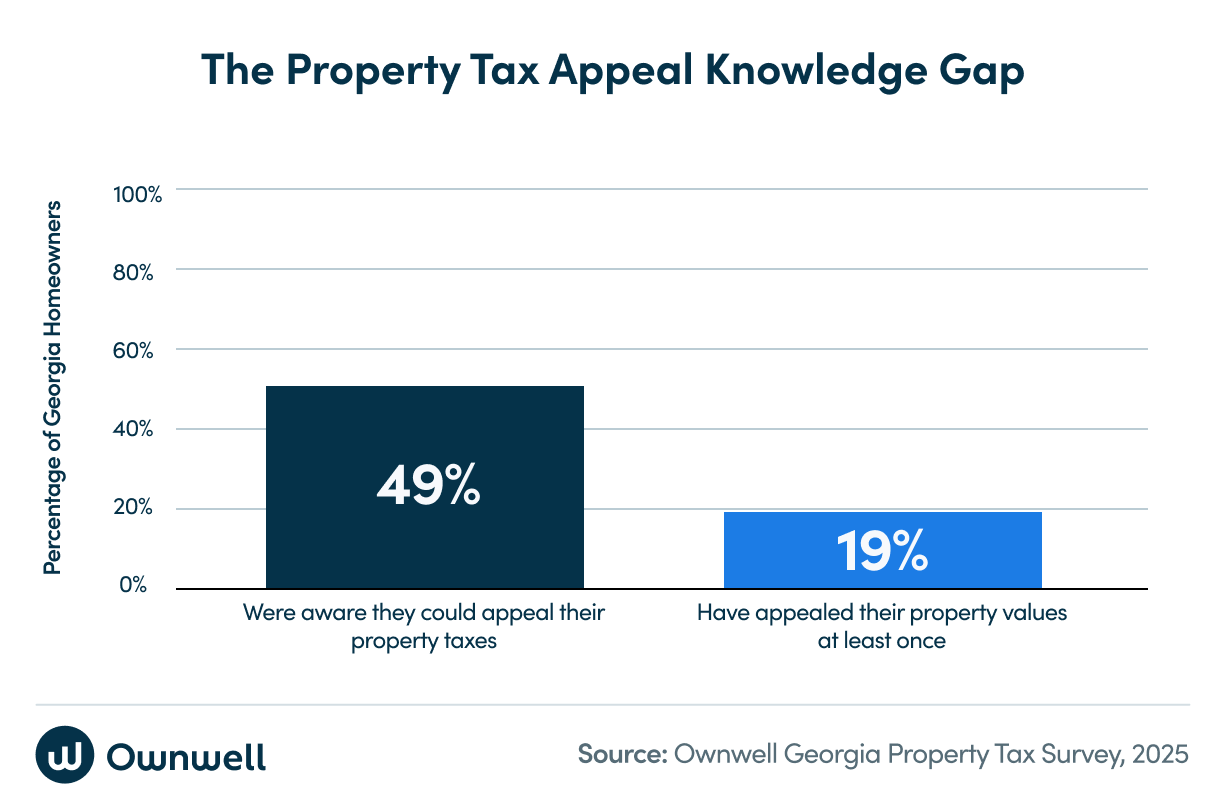

Unfortunately, 81% of homeowners have never appealed their assessment. One of the main reasons is limited knowledge. We found that 51% of Georgia homeowners aren’t even aware they can appeal their property tax assessment.

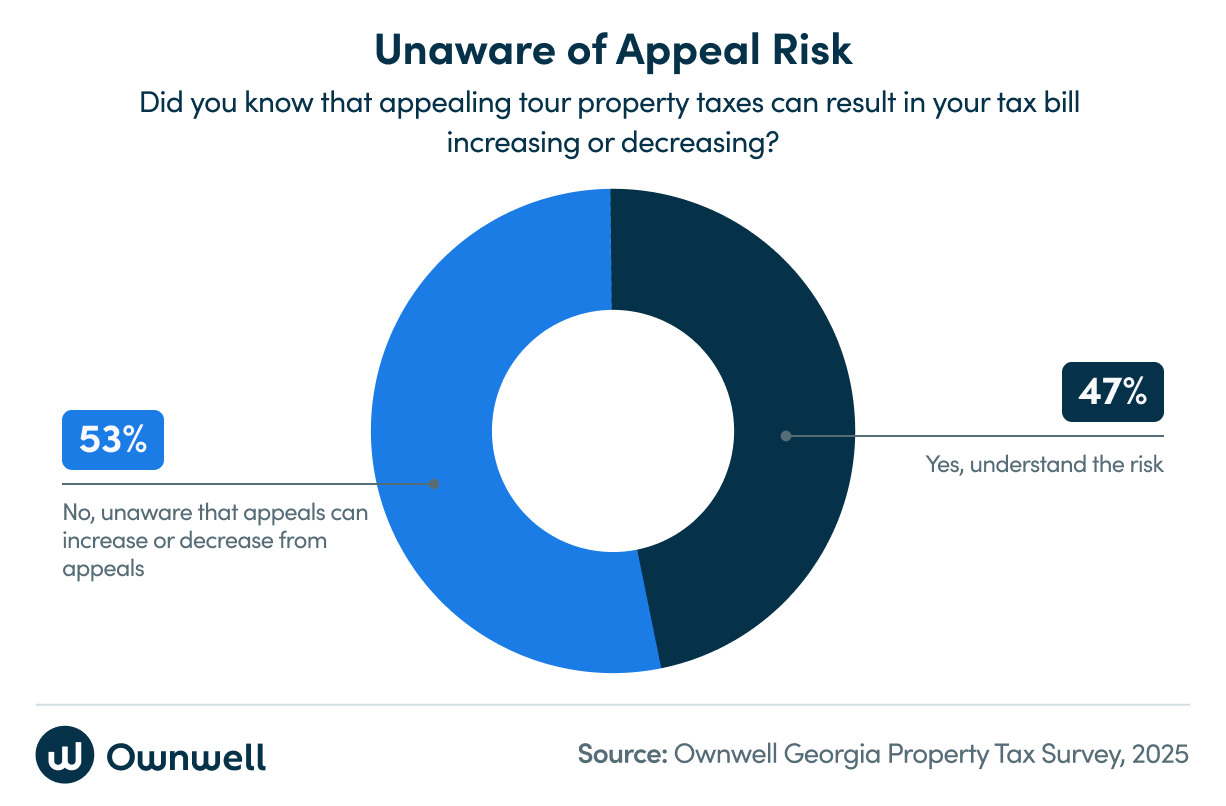

Here's a critical finding explaining some hesitation: 53% of homeowners don't know that appealing property taxes can increase or decrease their bill. This lack of understanding about appeal risks could paralyze many homeowners who might otherwise challenge their assessments.

Even Knowledge Doesn't Guarantee Action:

However, given more details and knowledge, skepticism remains strong.

When informed about their right to appeal, Georgia homeowners' responses reveal continued hesitation:

Only 18% plan to pursue an appeal.

Over half (55%) will consider an appeal, but need more information

The remaining 27% won’t appeal because:

11% don’t think they’d save enough money to make it worth their time

11% believe they received a fair assessment this year

6% don't know how

This means that even after learning about their rights, 82% of homeowners remain unlikely to take definitive action, leaving potential savings on the table.

Critical Property Tax Laws Remain a Mystery

Shifting gears, Georgia has enacted several laws to help homeowners manage the property tax burden, but awareness is low.

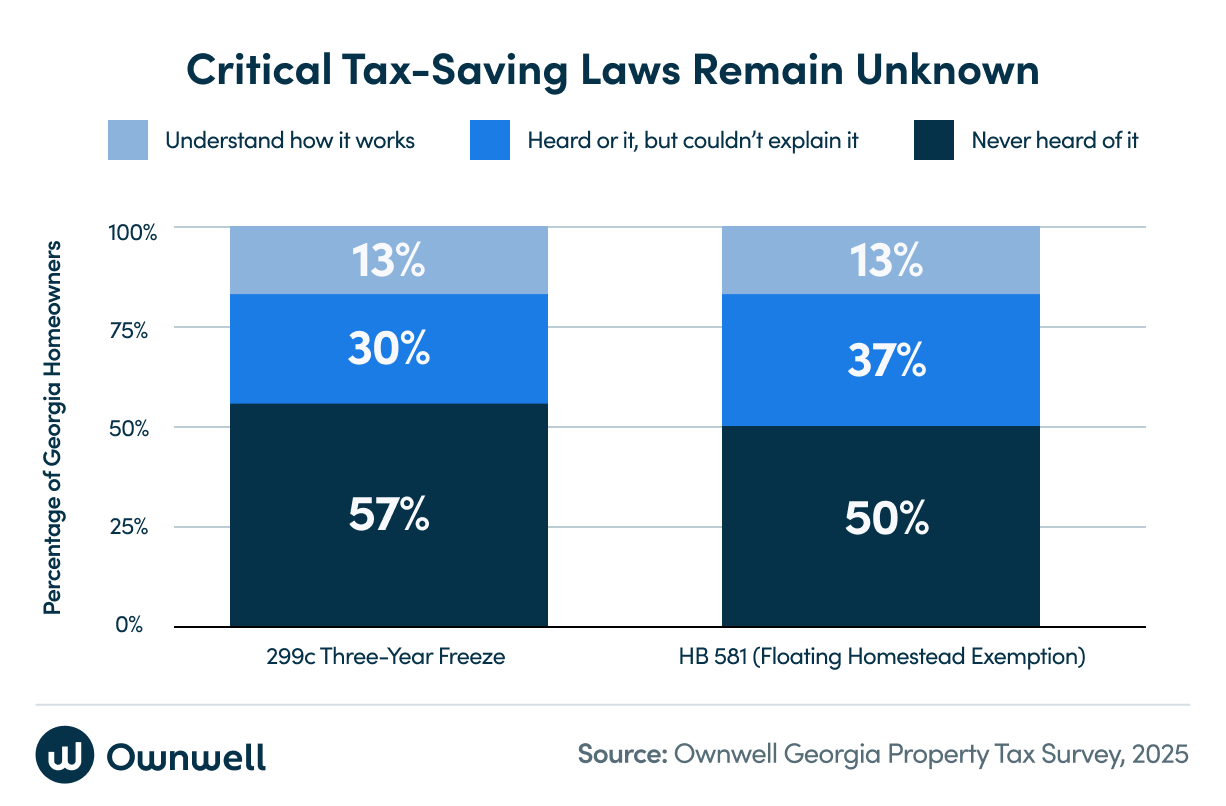

Georgia's 299c Three-Year Property Tax Freeze:

After a successful property tax appeal, under the 299c property tax provision, homeowners can lock in their assessed value for three years — a powerful tool that helps with budget certainty. Unfortunately:

The majority, at 57%, have never heard of it

Around 30% have heard of it but couldn’t explain how it works

Only 13% actually understand this money-saving provision

House Bill 581: The "Save Our Homes Act" and “Floating Homestead Exemption”:

Similarly, the floating homestead exemption, which Georgia voters passed in the November 2024 general election, can provide significant tax relief.

However, like the 299c three-year freeze, many Georgians are unaware of it.

Exactly half have never heard of it

37% have heard of it but can't explain how it works

Scarcely, only 13% understand how to benefit from it

The floating homestead exemption required local governments, such as counties, school districts, and cities, to decide on participation by March 1, 2025.

Unsurprisingly, our survey revealed significant confusion:

Nearly two-thirds (62%) were unaware whether their local governments opted in or out.

Of the remaining 38%, 22% were aware their local governments opted out, and 16% knew their local governments opted in.

This widespread unfamiliarity with crucial property tax-saving laws means Georgia homeowners could be overassessed and thus overpaying.

This situation underscores the importance of improving awareness and access to information about potential tax-saving opportunities. Doing so can help ensure Georgia families only pay their fair share of property taxes.

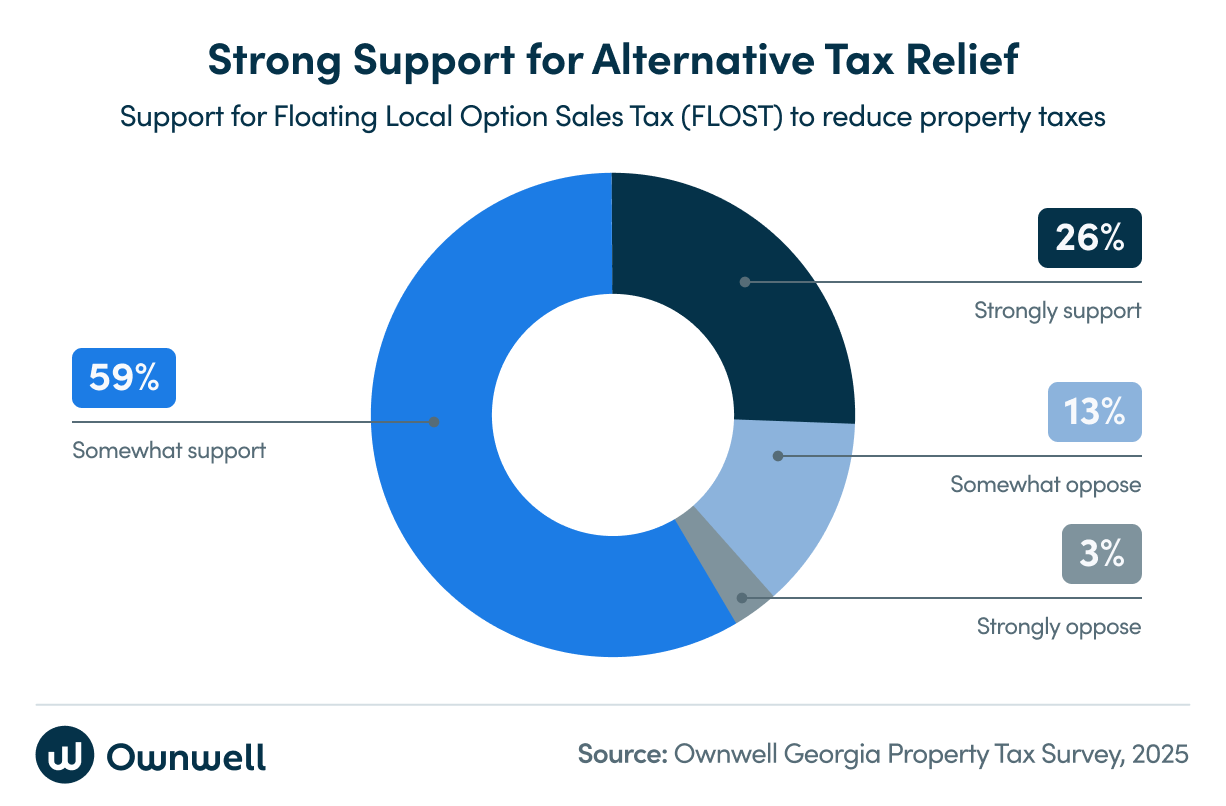

Georgians Support Creative Solutions

Despite the confusion and frustration, homeowners strongly support innovative property tax relief by implementing a Floating Local Option Sales Tax (FLOST) of up to 1% used to reduce property taxes.

85% support implementing a Floating Local Option Sales Tax (FLOST) if used to reduce property taxes; 26% strongly support this trade-off.

Of the 15% that oppose the concept, only 2% strongly oppose it.

The FLOST mechanism is part of Georgia’s HB-581 floating homestead exemption, but is only for those who opted in. This overwhelming support suggests that Georgia homeowners want property tax relief and are willing to consider alternative revenue sources.

The Hidden Cost of Inaction

The survey data paints a clear picture: Georgia homeowners face significant challenges due to increasing property assessments, recent property tax bills, and a lack of awareness about their rights and available tax relief options.

With 42% believing their homes are overvalued and 81% never appealing, it’s clear the homeowners aren’t taking advantage of tax-saving opportunities and could be overpaying on their property taxes.

Don’t Overpay on Property Taxes: How Ownwell Can Help

If you’re one of the 8 in 10 Georgia homeowners who’ve never appealed their property taxes, you could be paying more than you should in property taxes.

However, you don’t have to with Ownwell.

Georgia homeowners are feeling the squeeze of rising property values and confusing tax assessments. Our mission is simple: save homeowners money on their property taxes by helping them appeal the assessments they receive.

Georgia notices of values and assessments are often complicated, and local laws and provisions have changed in different counties after bills were passed last November.

We’re here to be the expert and do the hard work for you, so property owners and homeowners can save valuable dollars and better control their housing costs. — Colton Pace, Founder and CEO of Ownwell

Ownwell makes it easy to appeal your property tax assessment. We handle the paperwork and advocate for a fair valuation to help you get an honest frozen value for the next three years.

For non-frozen property and homeowners who’ve never appealed or had nominal success, now is the time to take action!

Enter your address to see how much you could save! We can also appeal your commercial or investment properties for you.

Methodology

Ownwell, in partnership with Pollfish, surveyed 863 Georgia homeowners from May 22 to June 2, 2025. The survey examined Georgia homeowners’ sentiment regarding property tax assessments and financial concerns, their knowledge of state laws, and their appeal behavior.

Lastly, please note that minor discrepancies in percentage totals (exceeding 100%) in pie charts are attributable to the rounding of figures to the nearest whole number.