Atlanta’s hospitality market is dynamic, fueled by events, travel, and a growing corporate base. However, behind the surface-level growth, deeper trends are emerging that smart hotel owners should address, especially when it comes to property taxes.

Key Market Shifts in Atlanta Hospitality

The hotel industry is currently facing several ongoing challenges and market dynamics, including:

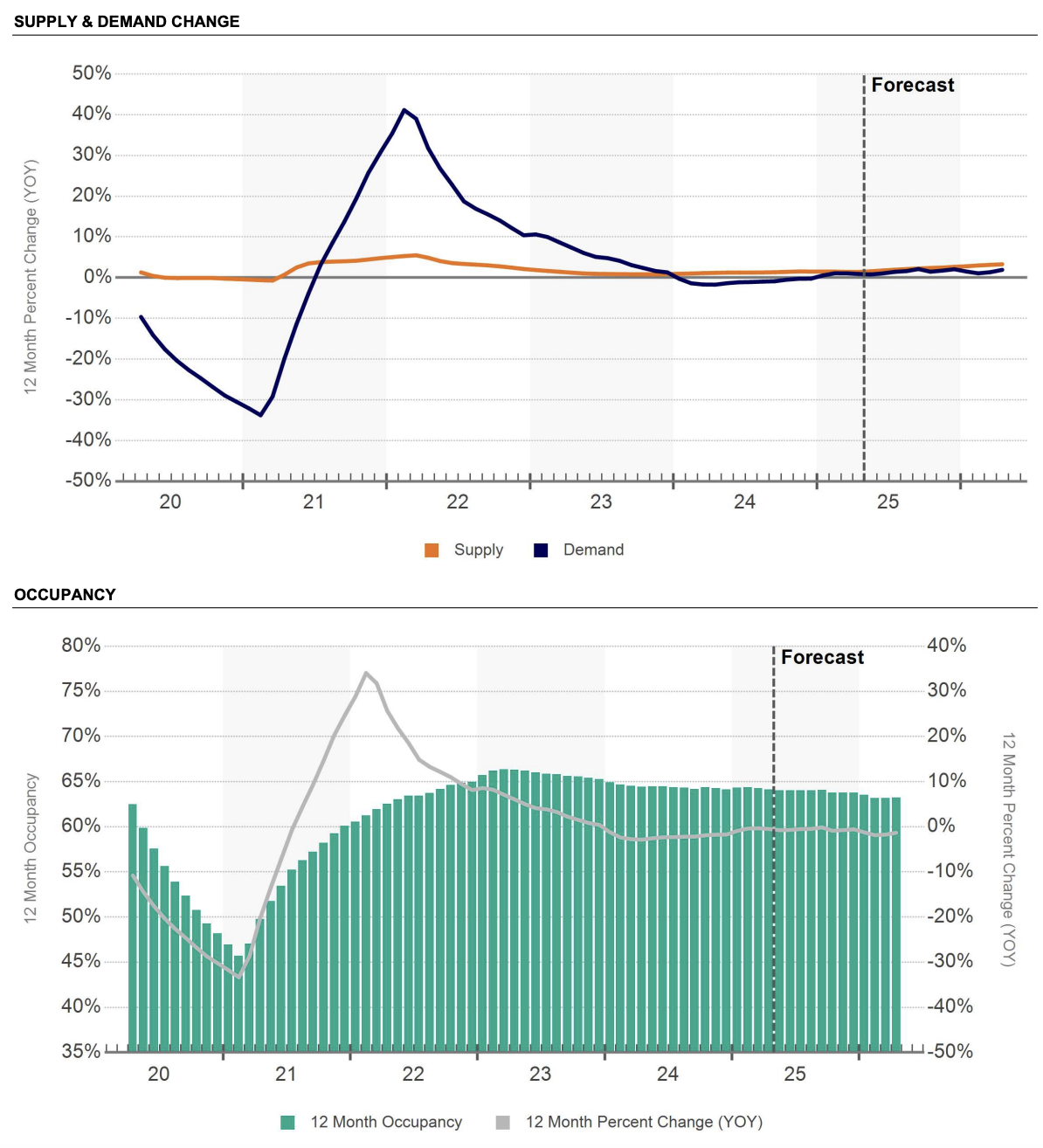

1. Occupancy remains stagnant: Despite events and increased travel, occupancy remains at 64.1%, still below the pre-pandemic benchmark of 70%.

2. ADR is driving RevPAR growth: Revenue per available room (RevPAR) increased by just 0.9% year-over-year, and this modest growth is entirely driven by average daily rate (ADR) increases, rather than rising occupancy.

3. New supply is adding pressure: With over 1,700 rooms set to open in 2025 and more than 7,000 rooms in planning, the market is bracing for a wave of competition, especially in the upper-midscale and upscale segments, which account for 75% of the pipeline construction.

4. Corporate and group travel is lagging: Even major venues like the Georgia World Congress Center are hosting fewer events compared to 2019, and group RevPAR is still below pre-pandemic levels.

Why This Matters for Property Taxes

While hotel income is fluctuating and occupancy remains soft, county assessors often rely on outdated performance assumptions. That’s a problem, because your valuation may be based on yesterday’s revenue, not today’s reality.

If you own a full-service, flagged, or boutique hotel, here’s what could be inflating your tax burden:

Assessor models assume higher occupancy recovery

Ignoring the impact of new competition

Applying cap rates from pre-2022 transactions

Not adjusting for shrinking group business or ADR-only growth

How Ownwell Helps Hotel Owners Push Back

At Ownwell, we're passionate about helping hospitality owners navigate property tax appeals.

Our team utilizes up-to-the-minute data, including RevPAR and ADR trends, hotel-specific profit and loss benchmarks (covering labor, insurance, and taxes), and a careful analysis of pipeline supply risks.

We also review CMBS and market sales comparisons to give a full picture.

Most importantly, we focus on creating appeals that truly reflect how your property is performing today, rather than just making estimated projections.

We're here to make the process clearer, fairer, and more tailored to your real-world results.

Let's Review Your 2025 Assessment

Own a hotel in Atlanta? This year is your window. With rising expenses and tepid growth, now is the time to push back on inflated tax values.

Book a no-cost, data-backed review with Ownwell today.