Atlanta’s Retail Market: Resilient But Cooling

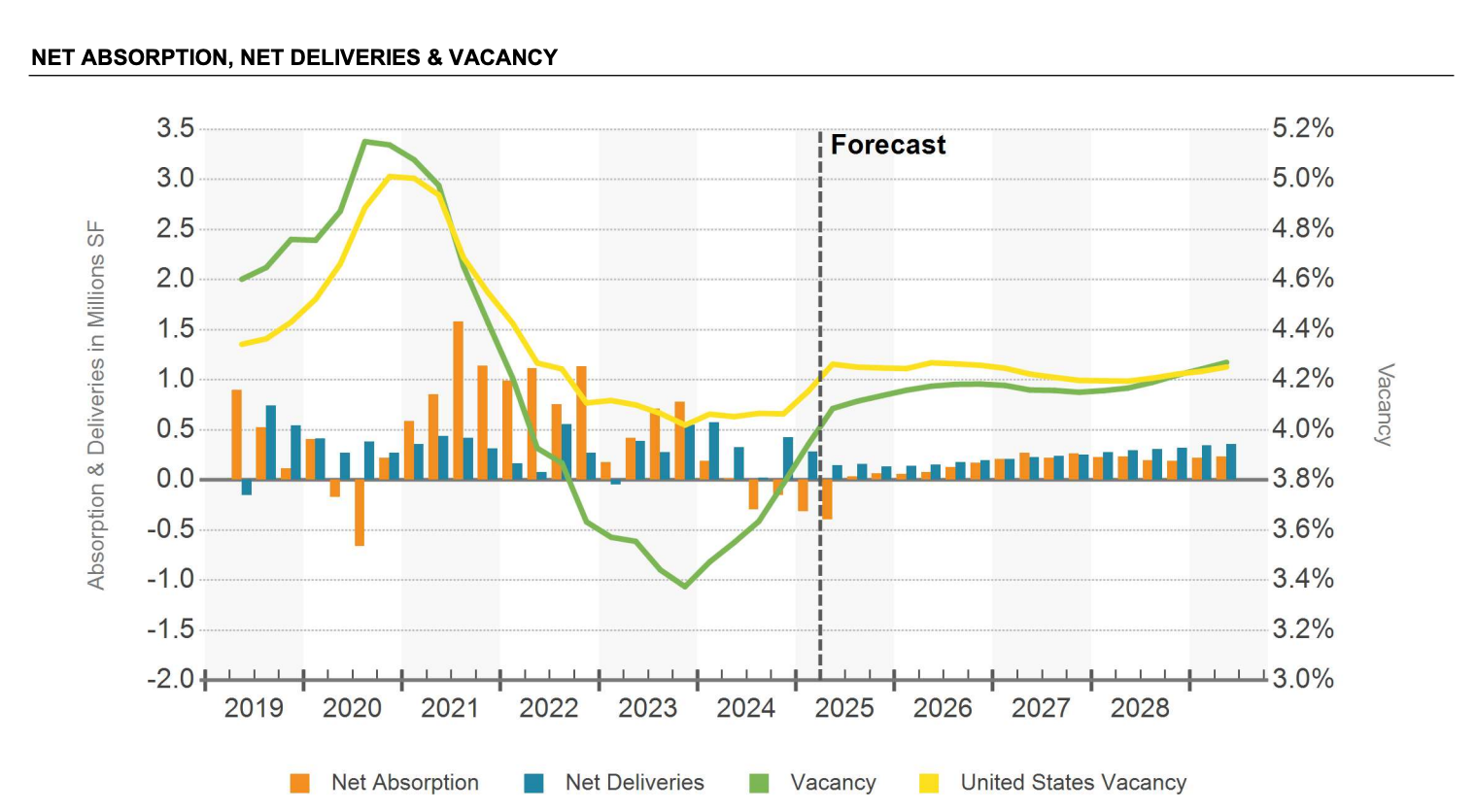

Atlanta’s retail market has remained impressively tight, with a 4.1% vacancy rate, outperforming the national average of 4.8%. While demand fundamentals remain sound — thanks to robust population growth and rising median incomes — the pace of absorption is slowing, and pockets of weakness are starting to emerge.

Even though net absorption turned negative over the past year and construction is subdued (just 0.2% of inventory is under construction), rents continue to climb. The average asking rent hit $23.29/SF, with some triple net lease (NNN) deals surpassing $70/SF for national tenants.

But Are County Assessors Accounting for the Full Picture?

Retail owners, especially those with NNN lease portfolios, often assume that because their centers are well-occupied, the county fairly assesses their property. But consider this:

Availability remains at just 4%, but it’s disproportionately higher in malls and strip centers

Retail rent growth has slowed sharply from 6% YoY in 2023 and is now just 4.4%

Submarkets like SE Atlanta and the CBD have seen significant negative absorption, with high vacancies not yet captured in blanket county models

Cap rates are hovering around 7.1%, while newer sales suggest values are softening in some nodes

NNN Lease Owners: You're Especially at Risk

Properties with strong tenants, long-term leases, and NNN structures are particularly prone to overvaluation by assessors, who may:

Apply cap rates from outdated peak sales

Assume NOI growth that's no longer materializing

Ignore emerging vacancies or increased TI costs required to backfill space

As a result, even well-performing centers may be overassessed.

Now Is the Time to Act

With leasing velocity slowing and market conditions normalizing, now is the best time to appeal before assessors catch up or dig in.

At Ownwell, we specialize in NNN retail property tax appeals. We analyze:

Local absorption and leasing comps

Recent sales and market cap rates

Tenant-specific lease structures

Submarket-level rent and vacancy trends

…and use that data to fight for a lower valuation and tax bill.

Ready to See if You’re Overpaying?

We’ll run the comps and do the analysis. You’ll only pay if we save you money.

Book a free review of your 2025 assessment here: ownwell.com/commercial