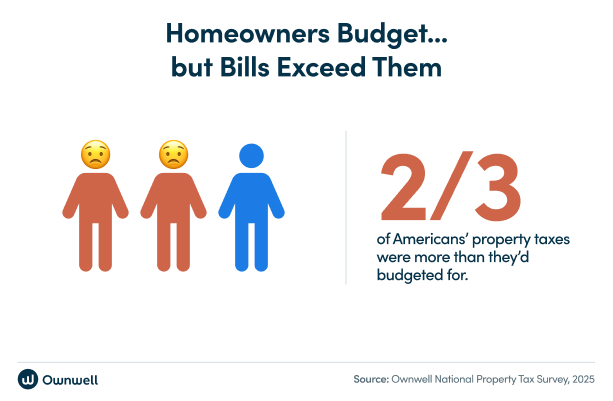

Opening your property tax bill can be an unpleasant surprise with lasting financial implications. Unfortunately, we found that in 2025, of the 82% of homeowners who budgeted for property taxes, two-thirds paid more than anticipated.

Fortunately, residential and commercial property owners who disagree with their assessed taxes can file an appeal — and professional help dramatically improves your odds of success.

In a property tax appeal, also known as an appraisal protest, you ask the assessor's office to reevaluate its determination of your market or assessed value. You can handle this process independently or get authorization and support from professional property tax consultants.

In this article, you'll learn the key differences between an Ownwell versus a DIY tax appeal and what the process usually entails.

Key Takeaways

Time Savings: DIY appeals typically require 2-10 hours of research and filing, while Ownwell takes about 3 minutes to set up.

Cost Structure: Ownwell operates on a "no-win, no-fee" basis, charging 25% of the actual tax savings with $0 upfront costs.

Success Rates: Professional consultants use adjusted sales data preferred by appraisal districts, often resulting in higher success rates than DIY attempts.

Strict Deadlines: Property tax appeal windows are narrow (usually 30–45 days); missing this window results in overpaying until the next assessment cycle.

How the DIY Property Tax Appeal Process Works

DIY property tax appeals are uncharted territory for many homeowners and property owners. Understanding what they involve is the first step when deciding whether to take advantage of property tax consulting or file an appeal on your own.

A Typical DIY Property Tax Appeal

Although some requirements differ based on your location, these are the basic steps of the property tax appeal process:

Research deadlines: Determine the timeframe for filing your appeal. Deadlines often range between 30 and 45 days from the date your county mails your assessment notice.

Gather evidence: Find documentation showing that the assessment of the market value for your property is too high. This might include sales prices for comparable properties or a recent appraisal.

Submit forms: Complete any necessary forms and submit them to the tax assessor's office. In many cases, you can file your appeal online.

Attend a hearing: You may have to present your appeal before a board of appraisers. They'll decide whether an adjustment is necessary based on your evidence.

If your tax assessor's office approves your appeal, you'll receive a new tax bill reflecting the change to your assessment.

Time, Effort, and Emotional Cost of DIY Appeals

Between 2019 and 2023, the median property reassessment for U.S. homeowners rose by 26.3%, averaging 6.6% per year. Meanwhile, appeal deadlines remain strict, typically just 30-45 days. Missing your window means potentially overpaying for years until the next assessment cycle. Seventy-eight percent of property owners never appeal despite believing their taxes are too high, often because the DIY process feels overwhelming.

DIY property tax appeals present numerous challenges, including:

Extensive Research: Hours spent studying local property tax laws and real estate market trends.

Evidence Gathering: Identifying and adjusting comparable properties to meet appraisal district standards.

Administrative Burden: Managing complex paperwork and strict filing deadlines.

Technical Complexity: Navigating legal terminology and attending formal hearings.

This time and effort could go to waste if the assessor's office declines to lower your home's property taxes. In some states, such as Georgia, a failed appeal can result in a higher market value and, consequently, a higher assessed property value.

The complexities of property taxes could also result in you making a mistake. Common errors, such as providing incomplete evidence or missing the submission deadline, often result in a failed appeal.

The biggest mistake in DIY appeals is homeowners using unadjusted sales comps from realtors, whose evidence often gets ignored because the appraisal district's evaluation differs. Without proper adjustments, their evidence is often ignored, and their appeal does not get the attention or consideration it deserves.

That's how we can help by knowing precisely what the appraisal district or appraiser is looking for and having a deep understanding of how to pick apart their evidence to make the best case. — Kyle Breazeale, Property Tax Consulting Manager at Ownwell

As one of our customers explains, working with Ownwell relieves these concerns from your shoulders:

Last year was the first time we have ever appealed property tax, and it was a breeze to work with Ownwell. It probably took me 10 minutes to fill out the questionnaire, and Ownwell took care of the rest.

Compare with my friend's DIY experience where she had to collect evidence, communicate with [the] tax bureau, and attend the hearing, I personally think the 25% fee Ownwell charged on the tax savings was pretty reasonable. — Sophia

How Does Ownwell Compare on Cost and Results?

Working with an Ownwell property tax consultant with experience in property tax appeals can make your appeal more successful without straining your budget. The chart below breaks down the differences in cost:

DIY Property Tax Appeal | Ownwell Property Tax Appeal |

|---|---|

Extensive hidden costs, including lost time | No upfront costs, only 25% of verified tax bill savings |

Labor-intensive filing process (2-10 hours) | Sign up in 3 minutes and get peace of mind with local expertise |

Potential lost savings | Greater savings |

Possible fees for incorrect filings | Accurate filings and no upfront fees |

As this customer describes, Ownwell manages every stage of the appeal-filing process:

Ownwell made the property tax protest process simple. They handled everything from start to finish and successfully lowered my taxable property value by 10%. I didn't have to do anything but authorize them to handle it and pay the bill at the end — super easy!! Highly recommend if you're looking to save on property taxes without figuring out the process yourself. — Steph F.

Ownwell is also more affordable than other local companies. For example, some tax consultants in Texas claim up to half of your tax savings, whereas in Georgia, many charge fees ranging from $150 to $500.

Want to Try What Made Ownwell Famous?

Do Professionals Actually Deliver Better Outcomes?

Our property tax consultants are local and knowledgeable about tax appeals for both residential and commercial properties. As a result, customers save both time and money. These client testimonials underscore the value of working with our professional tax consultants:

Ownwell's service is incredibly client-friendly. I simply plugged in my information, and they took care of everything. — Allen J., who saved $2,660

Working with Ownwell was like having a property tax superhero on speed dial! They slashed my warehouse's assessed value from a staggering $6.47 million to just under $2 million, saving me $65,000. — Jon T.

Stop Overpaying and See Your Savings Potential in 3 Minutes

If you believe your property tax bill is incorrect, you can submit a DIY appeal. However, the process is complicated and requires accurate documentation, strong evidence, and a deep understanding of local tax laws.

Our local experts have successfully reduced taxes for over 500,000 property owners. Don't risk leaving money on the table with a DIY approach when professional help costs nothing upfront and only charges if you save.

With Ownwell's expertise, you can save a significant amount on your property taxes. Enter your address for assistance with your property tax appeal to see how much you can save!