Harris County Property Taxes

Lower my property taxes with Ownwell

Ownwell's technology and tax experts save customers $774 on average.

File my tax exemption with Ownwell

Ownwell can help you file and ensure you get any applicable refunds.

View or pay taxes on HCAD

View you tax statements. Pay online or by phone. Enroll in a payment plan.

Search county records on HCAD

Conduct a real property, business personal, or mineral property search.

Go to HCAD.org

What you want isn’t on this list.

This page is designed to offer guidance on navigating property taxes in Harris County. It is not intended to imitate or mislead property owners in any way.

Ownwell Featured in

Our Customers

From reducing tax bills to saving money on home internet and beyond, we offer homeowners one place for savings.

We have an experienced team dedicated to maximizing savings for customers over 1000s of properties.

Specialized members across multiple asset classes paired with best in class technology to get you the best results.

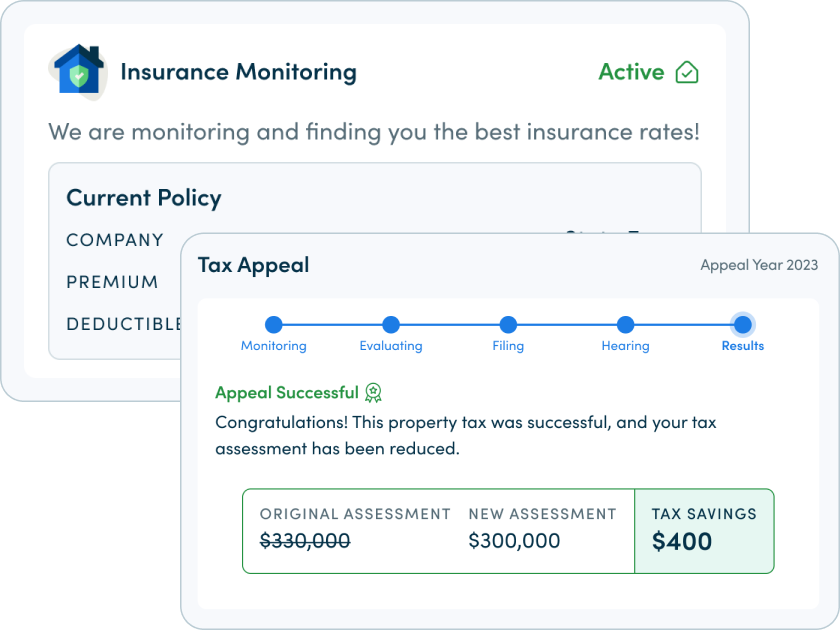

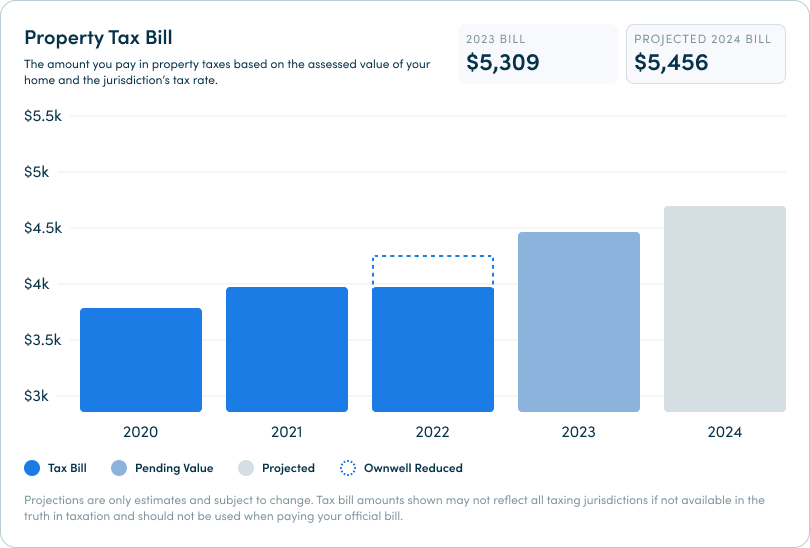

Our Product

With just your address Ownwell can analyze your property to identify the best way to reduce your property tax bill and then work to get the savings you deserve. Through your personalized property portal, you'll unlock opportunities to save on home insurance, monitor your home's value, receive forecasts for future tax bills, trim expenses on utilities like internet, and much more.

Our Technology

We combine real time market data, local expertise and cutting edge technology to identify and minimize overpaying on your biggest home expenses. Leveraging data and automation allows us to reduce costly overhead, which means we can pass more savings on to you.

Our Results

88%

Success Rate

$774

Avg Annual Savings

4.7

3,000+ Google Reviews