Cobb County, Georgia, remains one of the fastest-growing counties in Atlanta. Cobb County's estimated 2025 population is 786,549, with a growth rate of 0.63% in the past year. Cobb County is the third-largest county in Georgia. According to the Atlanta Regional Commission’s forecast, the county's population will grow by 40% and reach 1.04 million by 2050.

Though moderating from previous years, this continued growth impacts property values and property taxes. Cobb County's once red-hot real estate market is cooling, prompting the Board of Tax Assessors to predict a modest 2% increase in the 2025 tax digest.

"Two years ago, I told you the county's real estate market was traveling at 55 miles an hour; last year, I said it was going 35, and this year, we're at 20 miles an hour," said outgoing Chief Assessor Stephen White.

To better understand what to expect for the 2025 tax year, we need to examine the current market values in Cobb County and how they compare to last year.

Key Findings:

The Cobb County Board of Tax Assessors chose to revalue only around a third of residential properties.

The 32% of reassessed properties had a median market value increase of 8.59% from 2024 to 2025.

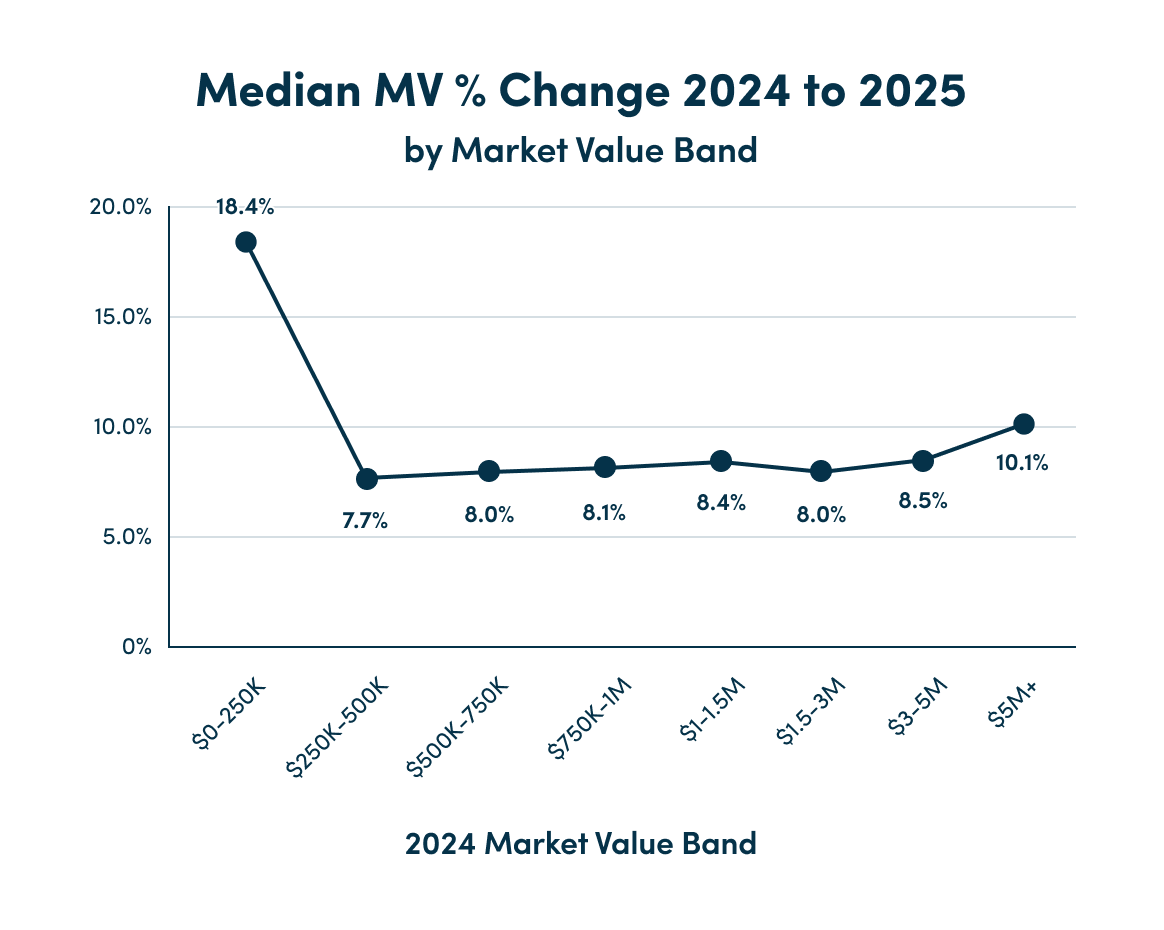

Residential properties under $250,000 had the highest median YoY percentage increase at 18.4%.

The median market value for all frozen properties (with or without a market value reassessment) is $406,900.

The median market value for reassessed frozen properties is $428,740 (+$21,840).

Cobb County’s Two Market Value Buckets

Primarily due to a relatively flat housing market, the Cobb County Board of Tax Assessors chose to revalue only 32% of properties. The 68% majority of residential properties had no market value change.

This decision creates a divergent pattern; while the overall market showed minimal growth, nearly a third of properties that received new assessments experienced a median increase of 8.59%. The remaining two-thirds received notice of values with no market value change.

All Non-Frozen Properties:

Total Properties: 228,894

2025 Median Market Value: $406,900

2024 Median Market Value: $395,320

Median Year-over-Year Percentage Change: 0%

Average Year-over-Year Percentage Change: 6.56%

Non-Frozen Properties With Market Value Changes:

Properties Reassessed: 73,253 (32% of total)

2025 Median Market Value: $428,740

2024 Median Market Value: $394,630

Median Year-over-Year Percentage Change: 8.59%

Average Year-over-Year Percentage Change: 20.49%

This data reveals a critical insight: While the overall median market value remained flat at 0%, the 73,253 properties that received new assessments saw their median values jump by 8.59%. Even more striking, these reassessed properties experienced an average increase of 20.49%.

The average home sales price in Cobb County increased by only $20,000 over the past year, bringing the average cost to nearly $500,000.

White noted in a Cobb TV interview, "Just two years ago, the average price of a home in Cobb County increased by $50,000; this year, it's only $20,000 — so things are changing.”

This Bifurcated Market Means That:

Only 32% of properties received new assessments, but those that did saw substantial increases.

Most homeowners (68%) saw no change in their median market values.

Property tax protests are especially critical for the 73,253 properties that received significant assessment increases.

The wide gap between median (8.59%) and average (20.49%) increases for reassessed properties suggests some homeowners faced dramatically higher assessments.

What's Happening Across Residential Market Value Bands

The impact of market value changes varies significantly across different property value segments. For this exercise, we’re examining the 73,253 residential properties in Cobb County that were reassessed and whose market value was changed by the county.

Overall, we're seeing a pattern where lower-priced properties are experiencing the strongest growth, while mid-range properties show more modest increases.

Entry-level homes under $250,000 are experiencing the strongest growth at an 18.4% spike, reflecting renewed interest in affordable housing and lower-cost neighborhoods.

Outside of properties worth under $250,000 and those over $5 million, which had a 10.1% increase, all other market value bands have median market value percentage change between 7.7% and 8.5%.

Why Cobb County Property Owners Should Appeal Their 2025 Tax Assessments

Understanding Georgia's Property Tax System

Georgia property taxes operate under several key mechanisms that impact Cobb County homeowners:

The Assessment Process: Georgia's assessment date is January 1 each year. Accordingly, all property must be valued for ad valorem taxes based on its condition and use as of January 1, 2025.

The Appeal Window: If the taxpayer wishes to appeal the fair market value on the notice of assessment, the appeal must be sent to the board of tax assessors and postmarked no later than 45 days from the mailing date of the notice of assessment.

The Power of the 299(c) Freeze

One of the most powerful tools available to Georgia property owners is the 299c property tax provision, which can provide significant tax relief:

The 299(c) freeze works as follows:

If you successfully appeal your property tax assessment and receive a reduction, your property value is frozen at that reduced level for three years.

The freeze may be lifted if the taxpayer files a return at a different value, the taxpayer files another appeal, or the taxpayer makes changes to the property, such as substantial additions or improvements.

Key Reasons to Appeal in 2025

1. Comparative Market Analysis Opportunities: With different market segments showing varying growth rates (from 7.70% to 18.43%), property owners can use comparable sales data to demonstrate if their property's assessment exceeds market reality.

2. 299c Freeze: As noted above, the 299c property tax provision freezes your assessed value for three years. As market values, and thus property tax bills, have risen over the past several years, including this one, it’s beneficial to appeal your property taxes to ensure you don’t miss critical tax savings.

The combination of:

A cooling market

The potential for a 3-year freeze through the 299(c) provision

Professional expertise in navigating the appeal process

...creates a compelling case for property owners to consider appealing their 2025 tax assessments.

Take Action With Ownwell

Don't navigate Georgia's complex property tax appeal process alone. Ownwell specializes in property tax appeals and can help you:

Analyze your property's assessment against current market data

Prepare a comprehensive appeal package

Represent you through the appeal process

Secure the valuable 299(c) three-year freeze

Maximize your homestead exemptions

With Cobb County's property market in transition and only a third of properties being revalued, now is the time to ensure you're not overpaying your property taxes, even properties with the same market value as last year.

Let Ownwell's experts help you keep more of your hard-earned money where it belongs: in your pocket.

See how much you’re overpaying in property taxes.