Fulton County, Georgia, home to Atlanta's urban core and with an estimated 2025 population of 1,089,919, remains the state's most populous county. The county experienced a 0.5% growth rate in the past year.

With this population growth, the county’s property tax landscape has become increasingly contentious. The commission voted to set the 2025 millage rate at 9.87 mills on a motion by Commissioner Mo Ivory. This represents a 1.096 mill increase over the 2024 rate of 8.87 mills, which required an increase in 2024 property taxes by 3.74%.

Beyond millage rate increases, to fully understand the actual state of Fulton County's real estate market for owners considering tax appeals.

Let's dive into the data to uncover where opportunities exist for property tax relief in this evolving market.

Key Findings:

Residential Stagnation: Median home values stay steady at $452,300, while 130,333 properties under $500,000 saw no growth or decline.

Commercial Divergence: Overall, Fulton County’s commercial market remained relatively steady, but certain sectors and market value ranges experienced notable growth. Industrial properties increased by 9.07%, and retail properties rose by 6.45%.

Residential Overview

Fulton County's Residential Market Shows Stubborn Stagnation

Fulton's residential market is essentially treading water, with median market values decreasing by 0.68% YoY, a stark contrast to the robust growth seen in previous years. This cooling represents a significant shift in one of Georgia’s wealthiest and most closely watched real estate markets.

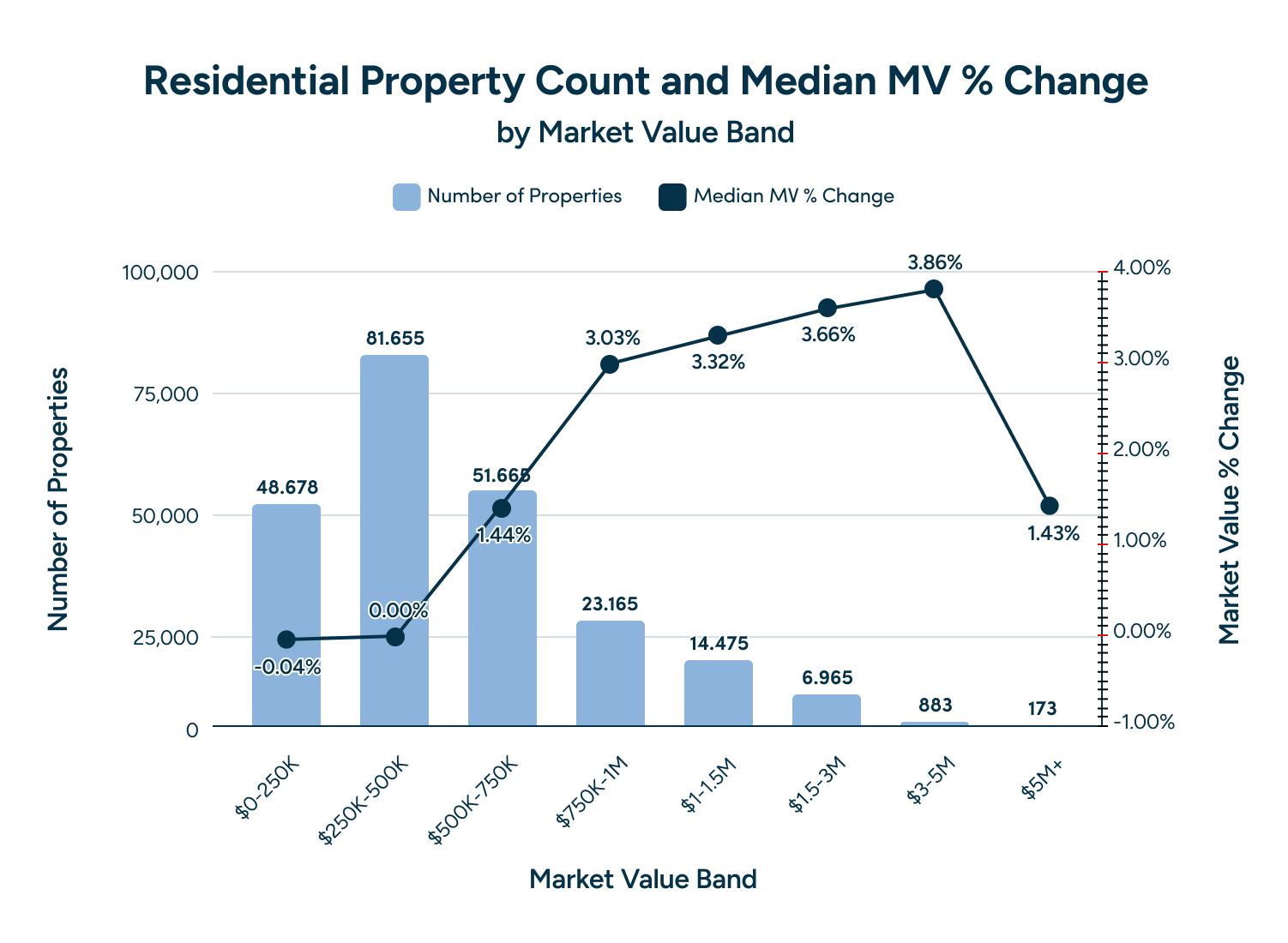

What's Happening Across Residential Market Value Bands

Based on our analysis of median market value changes from 2024 to 2025, Fulton County's residential property market exhibits a K-shaped recovery, where affordable housing stagnates while luxury properties surge.

Market Value Band | Median MV YoY % Change | Properties in Band |

|---|---|---|

$0-250K | -0.04% | 48,678 |

$250K-500K | 0% | 81,655 |

$500K-750K | 1.44% | 51,665 |

$750K-1M | 3.03% | 23,165 |

$1M-1.5M | 3.32% | 14,475 |

$1.5M-3M | 3.66% | 6,965 |

$3M-5M | 3.86% | 883 |

$5M+ | 1.43% | 173 |

Main takeaways:

The median home value in Fulton County is $452,300, representing no change over the past year. However, this median value masks the reality that most homeowners aren't seeing substantial appreciation, only those with homes valued over $500,000.

The data paints a troubling picture for middle-class homeowners. Properties under $250,000 — representing nearly 49,000 homes — saw values slip marginally at 0.04%. The massive $250,000 to $500,000 segment, encompassing over 81,000 properties and forming the backbone of Fulton's housing stock, experienced zero median price growth.

Luxury properties tell a different story, with homes valued between $1.5M and $3M jumping 5.12%. The ultra-luxury market, comprising homes valued over $5 million, experienced a 26.52% increase.

Commercial Real Estate: A Story of Surprising Weakness

While residential properties show mixed results, Fulton County's commercial real estate sector tells an unexpected story of broad stagnation, defying Atlanta's reputation as a booming business hub.

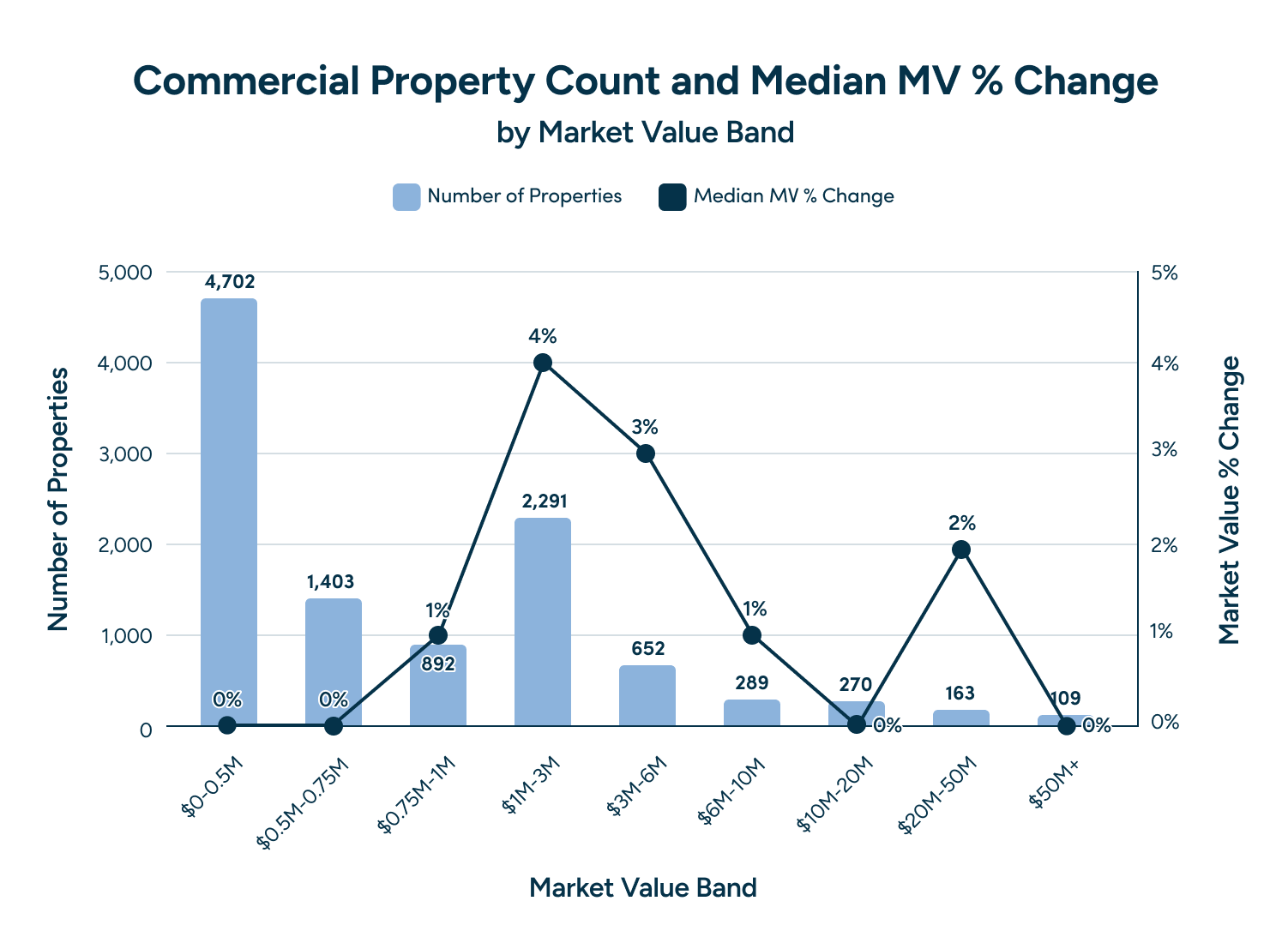

Overall Commercial Market Takeaways:

The median market value for commercial properties showed minimal movement across most segments.

Properties under $500,000 (representing 4,702 units) saw zero median value change.

Mid-market commercial properties ($750K-$1M) gained a modest 1.16%.

Only properties in the $1M-$3M range showed meaningful growth at 3.64%.

Commercial Property Analysis by Vertical

Industrial Properties: The Lone Bright Spot

Key Takeaways:

Industrial leads all sectors with 9.07% median value growth across 1,083 properties.

Every market segment showed positive growth, from small warehouses to mega-distribution centers.

Properties under $500K jumped 5.67%, while $3M-$6M facilities surged 15.67%.

The $20M-$50M segment saw 12.01% growth, reflecting institutional investor appetite.

Industrial's strong performance stands in stark contrast to other commercial sectors. E-commerce growth continues to support warehouse demand, with Fulton County's strategic location along major transportation corridors driving up values.

The sector's median property value rose from $4 million to $4.77 million, making it the only vertical with significant appreciation.

Office Properties: Complete Stagnation

Key Takeaways:

The office segment showed a 0% median value change across 3,139 properties — the largest commercial segment.

Every market segment, from under $ 500,000 to over $50 million, showed zero median growth.

Premium office towers valued at over $50 million declined by 5.78%.

The median property value inched from $3.85 million to $4.02 million.

The office segment's flatline performance across all segments signals deep structural challenges.

With 2,027 properties under $500,000 showing no growth and luxury towers declining, the work-from-home revolution has fundamentally reset Atlanta's office market. This complete stagnation across price points suggests the market hasn't found its floor.

Retail Properties: The Surprise Winner

Key Takeaways:

Retail defied expectations with strong growth across nearly all segments.

Small neighborhood centers under $500,000 gained 5.12% in median value (1,355 properties).

Mid-market retail ($1M-$3M) performed best with 9.13% growth (1,038 properties).

Properties in the $6M-$10M also surged 8.93% (92 properties).

Only mega-malls or extremely high-end retail spaces over $50 million declined, dropping 6.56% (just 14 properties)

Deep Dive: The K-Shaped Retail Recovery

Retail's performance tells a compelling story of adaptation and resilience. The data reveal a clear winner's circle: properties valued between $750,000 and $10 million consistently outperformed, with median gains ranging from 6.67% to 9.13%.

This sweet spot encompasses neighborhood shopping centers, grocery-anchored strips, and lifestyle centers that cater to daily needs and lifestyles.

The decline in mega-mall values (over $50 million) confirms a suspected trend: the era of the traditional enclosed super-regional mall is shifting. With only 14 properties in this category and values dropping 6.56%, these properties in Fulton County are facing significant challenges.

Multi-Family Properties: Mixed Signals

Key Takeaways:

The multi-family sector showed a zero percent median value change overall across all 1,101 properties.

Small properties under $ 500,000 surged 12.05%, reflecting strong demand for single-family rentals.

Mid-market apartments ($750K-$10M) showed zero growth across the board.

Large complexes ($20M-$50M) jumped 22.73%, driven by institutional acquisitions.

The divergent multi-family market tells two stories with growth on the low and high end of market value bands.

While overall median values barely budged from $4.03 million to $4.09 million, the extremes on both ends moved dramatically.

Landlords are facing increased competition as new apartment buildings open in Fulton, Gwinnett, and Cobb counties, creating a winner-take-all dynamic where only the smallest and largest properties are likely to appreciate.

Lodging Properties: Uneven Recovery

Key Takeaways:

Hotels also showed a 0% median value change across just 112 properties.

Budget hotels under $1 million remained stagnant, with no change in median value.

Mid-tier properties ($3M-$6M) gained 3.4% and $6-10M gained 1%.

Luxury resorts with a value of over $50 million increased by 2.77%.

Lodging's flat overall performance masks significant variation by property type. While median values edged from $4.34 million to $4.85 million, the sector remains challenged by reduced business travel.

Select-service and lifestyle hotels in prime locations in Fulton County outperform, while convention hotels and budget properties struggle.

Why Fulton County Property Owners Should Appeal Their 2025 Tax Assessments

Understanding Georgia's Property Tax System

Georgia's property tax system provides several mechanisms that savvy property owners can leverage:

The Assessment Process:

All property is valued based on its condition and use as of January 1 each year for ad valorem taxes. Georgia law requires all property to be returned and assessed at its fair market value each year.

The Appeal Window:

If the taxpayer wishes to appeal the fair market value as stated in the notice of assessment, you or your authorizing agent must send your appeal to the board of tax assessors and postmarked no later than 45 days from the date the notice of assessment was mailed. This typically falls between late April and late June.

Key Reasons to Appeal in 2025

1. Stagnant Values Create Assessment Disparities:

With residential values essentially flat and commercial properties showing minimal growth, any assessment increase is likely to overstate actual market conditions.

The disconnect between actual market performance and assessment increases makes appeals particularly compelling.

2. Market Bifurcation Creates Comparison Opportunities:

The dramatic differences between property segments — luxury homes soaring while middle-market properties stagnate — provide rich grounds for appeals.

Your property's assessment should reflect its specific market segment, not county-wide averages.

3. Long-Term Protection Through 299(c):

Successfully appealing now doesn't just reduce your 2025 taxes; it locks the assessed value for three years via Georgia’s 299c property tax freeze. Given Fulton County's history of aggressive rate increases, securing a three-year freeze could result in significant savings of thousands of dollars.

Appeal With Ownwell

Navigate Georgia's complex property tax appeal process with confidence. Ownwell's data-driven approach combines:

Comprehensive market analysis using the latest comparable sales

Professional appeal package preparation meeting all statutory requirements

Expert representation through every appeal level

Aggressive pursuit of the valuable 299(c) three-year freeze

No upfront costs—we only get paid when we save you money

Fulton County's real estate market is tricky. While most property values remain unchanged, luxury homes are selling for significantly more. Because of this, you need an expert to make sure your property assessment is fair and accurate.

Let Ownwell's experts ensure you keep more of your hard-earned money where it belongs: in your pocket. See how much you're overpaying in property taxes.