As a property owner in Cobb County, Georgia, you must pay Cobb County property tax payments yearly. These taxes support services and infrastructure in the county.

Your annual notice of assessment shows the assessed value of your property as of January 1, 2025. If you disagree with your assessed tax value, you have 45 days to file an appeal by mail or online. The countdown begins on the date specified in the notice.

Read on to learn about the property tax assessment appeal process. You’ll also learn how Ownwell can ensure you get the tax savings you deserve.

Property Tax Assessments

Cobb County tax assessments are complicated. Here’s a breakdown of how they work.

How Property Tax Assessments are Calculated

Cobb County's main property tax is based on the ad valorem system, which means it's tied to the property's fair market value. To determine your tax, the county takes 40% of your property's appraised market value and then applies a millage rate, which is expressed per $1,000 of assessed value. County and school officials determine the tax rate (millage rate).

For example, suppose your property's appraised market value is $400,000. Your assessed value is 40% of that, or $160,000. If the millage rate is 30 mils, the property tax bill equates to $160,000 ÷ 1,000 × 30 = $4,800.

Key Factors Affecting Property Valuations

To determine property valuations, the Cobb County Board of Tax Assessors looks at various factors, including:

Location: Proximity to transportation, schools, and amenities can significantly affect value.

Physical characteristics: Larger properties in good condition usually have higher values.

Cobb County's trends: Current Atlanta real estate trends affect property values, including demand and supply.

Planned developments: Areas with these may have higher property values.

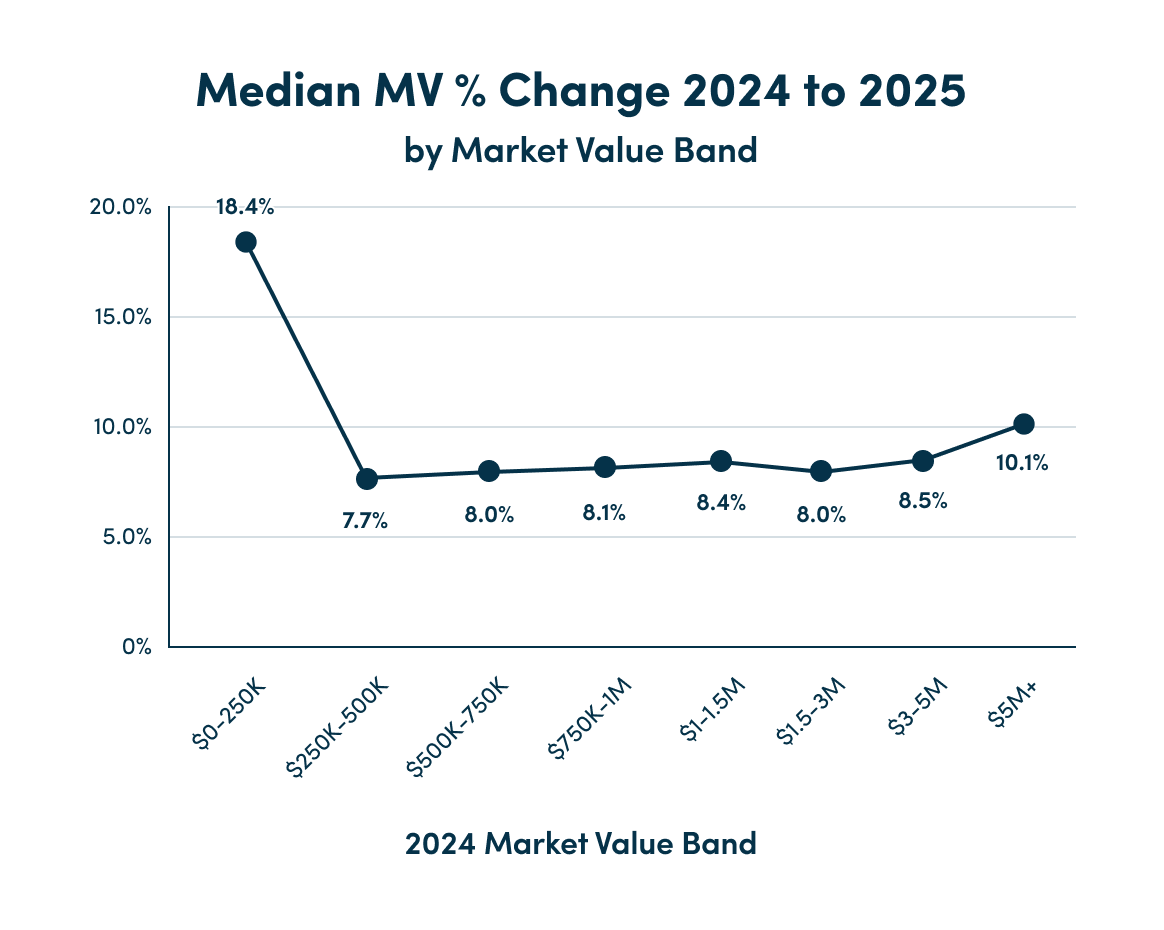

Cobb County recently released market and assessed values. Similar to the past couple of years, property taxes continue to rise, particularly for lower-valued homes. You can read our full 2025 Cobb County residential property tax report here.

Property Tax Exemptions

To determine the property's market value, the county takes 40% of your property's appraised market value. If you're eligible and apply for any tax exemptions, the county will also apply those deductions to the 40%.

You can apply for tax exemptions through the Cobb County Tax Commissioner’s Office. To be eligible, you must own and occupy the property as your primary residence on January 1 of the year of application.

There are several Cobb County property tax exemptions:

There's a $10,000 Cobb County basic homestead exemption in the county general and county general tax categories.

You can receive an exemption from all school bonds and school general tax categories if you're 62 years old on or before January 1 of the current tax year.

A $22,000 exemption in all tax categories besides the state is available if you were disabled on or before January 1 and your annual net income from the previous year didn't exceed $12,000.

There's also a $4,000 exemption in the county bond, state, and fire district tax categories.

To be eligible, you must be 65 years old on or before January 1, and your annual net income can’t exceed

$10,000 for the previous year. You also need to qualify for the $4,000 exemption for individuals aged 65 and over, as outlined in the income affidavit.

State veterans’ disability is an exemption that applies across all tax categories.

To qualify, you must be a disabled veteran as defined by O.C.G.A. § 48-5-48, have a 100% service-connected disability, and be compensated at 100% due to unemployability.

You must also provide a Veterans' Administration letter when applying, showing the effective date of your 100% service-connected disability.

Note that Cobb County has chosen to opt out of the floating homestead exemption (HB 581). This means it won't adopt the HB 581 tax formula, which would limit school funding.

How Conservation Programs Can Reduce Tax Liability

The Conservation Use Value Assessment (CUVA) seeks to incentivize landowners to utilize their land for timber production, agriculture, or environmental conservation.

To qualify for CUVA, your property must be at least 10 acres and devoted to good faith timber or agricultural production for 10 years. By enrolling eligible land in CUVA, you can save 50% or more on property taxes.

Property Tax Appeal and Payment Dates

This year, the annual notice of assessments (the documents showing the assessed property price) were mailed out on May 23 for commercial city and residential properties. The appeal deadline is 45 days after the notice date, so you have until July 7 to file a Georgia property tax appeal.

Cobb County usually sends out property tax bills by August 15 each year, with payment expected by October 15. If you're seeking an exemption, apply by April 1 to have it count for that year's taxes.

Taxes not paid by the due date will accrue a 5% penalty plus additional interest every month until you pay in full.

The Timeline and Strategies for Appealing Property Taxes

If the value listed on your annual notice of assessment doesn’t reflect your property’s true worth, you have the right to challenge it. In Cobb County, you have until July 7, 2025, to submit an appeal.

Here’s what you need to know to maximize your chances of overturning the assessed amount.

Understanding the Notice Details

First, review your annual notice of assessment carefully. This document lists your property’s current fair market value, assessed value, and any applicable exemptions. Please note that the annual notice of assessment is not a bill. However, it will determine what you will eventually owe in taxes.

Ensure the figures are accurate. If anything appears to be amiss, note it down. You can use these notes as the foundation of your appeal.

Timelines for Response and Action

Again, in Cobb County, you have 45 days from May 23 (so, July 7) to file an appeal. That’s why it's critical to read your notice as soon as it arrives.

If you're filing by mail, your appeal must be postmarked on or before the deadline. If filing online, be sure you receive a confirmation of submission. Late appeals are typically not accepted, regardless of how valid your arguments might appear.

Steps to File an Appeal

Cobb County lets you start an online appeal or file an appeal by mail or in person. To start an online appeal, search for the property using the Cobb County government website’s property search tool.

Then, click the Appeal to the Board of Assessors button at the top of the webpage. Follow the instructions and include strong evidence, such as your Cobb County property tax records. Finally, click the “Approve and submit this appeal” button to send the appeal to the tax office.

Alternatively, you can mail the appeal or deliver it in person to the Cobb County tax office. The appeal should include the Cobb County appeal form (available through the Cobb County site) and a letter explaining why you disagree with the assessed value, that you are appealing, and your property’s street address and parcel ID number.

Once your appeal is received, the Cobb County tax office may respond with an amended notice of assessment. If you still disagree, you can escalate the appeal to the Board of Equalization (BOE) for a hearing.

BOE meetings are conducted daily for weeks or sometimes months until they're completed. The clerk and members start by informing taxpayers of their rights. After that, the property owner will be asked if they would like to present first. After they present their case, the Cobb County tax assessor will present theirs.

BOE members will make a decision based on both parties. The property owner and the tax assessor’s office have two choices: accept the BOE ruling or appeal further to the Superior Court.

Common Grounds for a Successful Property Tax Appeal

Successful property tax appeals tend to focus on proven factual discrepancies. These include:

Sales data showing comparable homes in your area are valued lower

Factual errors on your property record, such as incorrect square footage

Condition issues like foundation damage or a roof in disrepair

Lack of updates in the tax assessor’s database despite market changes

If you can show that the Cobb County tax office’s valuation is unrealistic or unfair, your chances of success improve significantly. Documentation — such as contractor estimates, inspection reports, or recent appraisals — can significantly strengthen your case.

Talk to a tax expert — like Ownwell — to see how you can strengthen your case. An expert can also help build a case on your behalf, allowing you to focus on property management and other aspects of your life.

Manage Your Property Tax Bills Effectively With Ownwell

Managing, paying, and determining whether your property tax bills were assessed properly can be daunting, especially when you’re already so busy with work and your personal life. That’s where Ownwell comes in. We provide local tax experts who can help ensure you’re paying the right amount of property taxes.

Once our tax experts evaluate your case, you’ll only have to pay if you save. On average, 86% of our clients have received a reduction, resulting in $1,102 in savings.

See how much you can save today and learn how we own the entire Cobb County appeal process for you, from tax assessor property searches to case filing and more.