Need to update your property details on Ownwell? Learn how to edit your information for a stronger tax appeal case.

We utilize several unique data sources to validate property characteristics, but they aren’t always up to date. You know your property best. Fixing incorrect information or adding new details about your property can help Ownwell’s property tax professionals improve your case for a property tax assessment reduction. If you are correcting or adding major details like purchase date/price, square footage, or property type, we encourage you to upload evidence that can support the correction to the documents tab.

To update your property details, follow the steps below:

-

Sign into your property portal at ownwell.com/sign-in.

Not familiar with Ownwell’s property portal? Learn how to claim your account here.

-

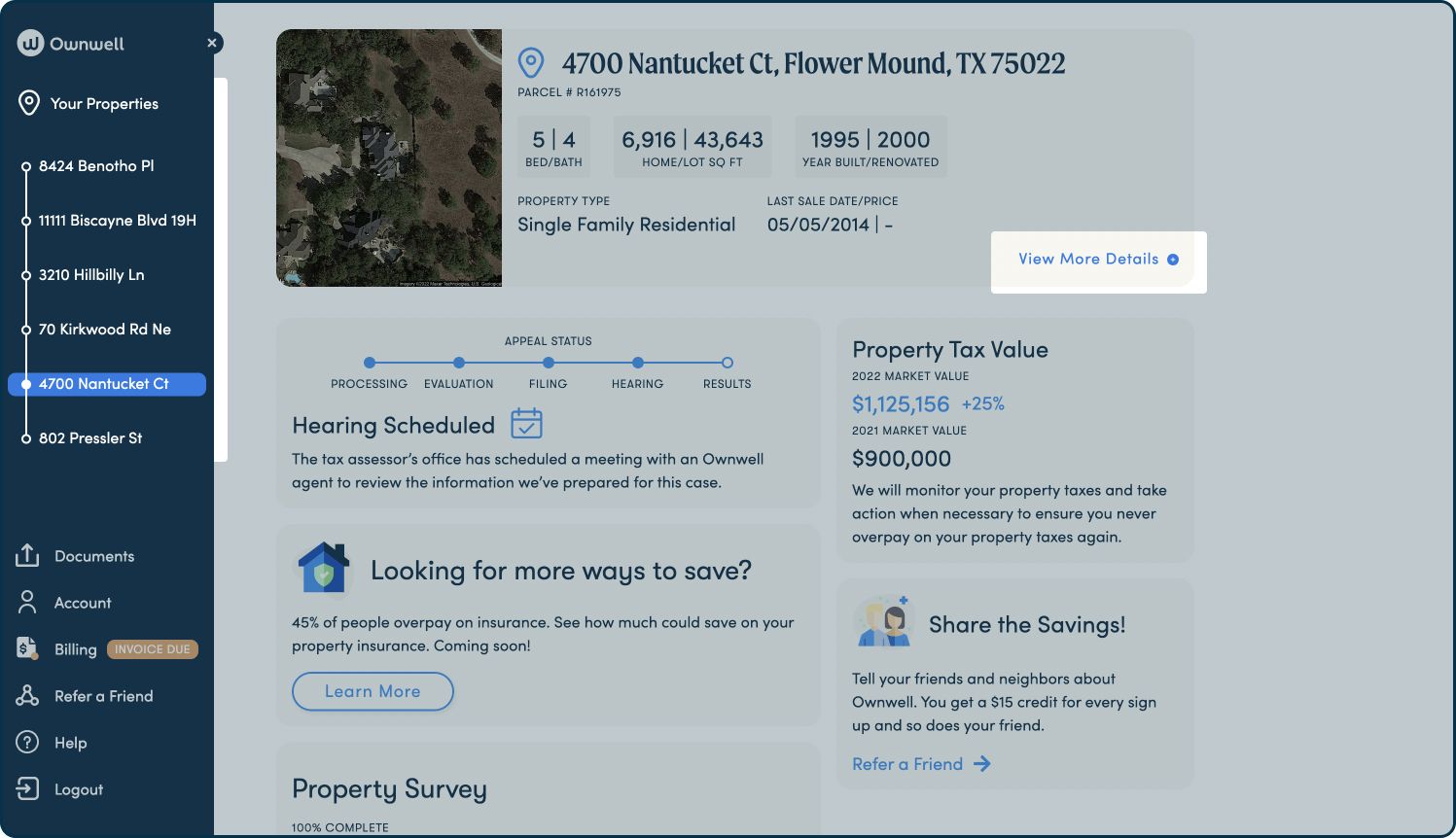

Once in your portal, select the property you would like to edit under “My Properties”.

-

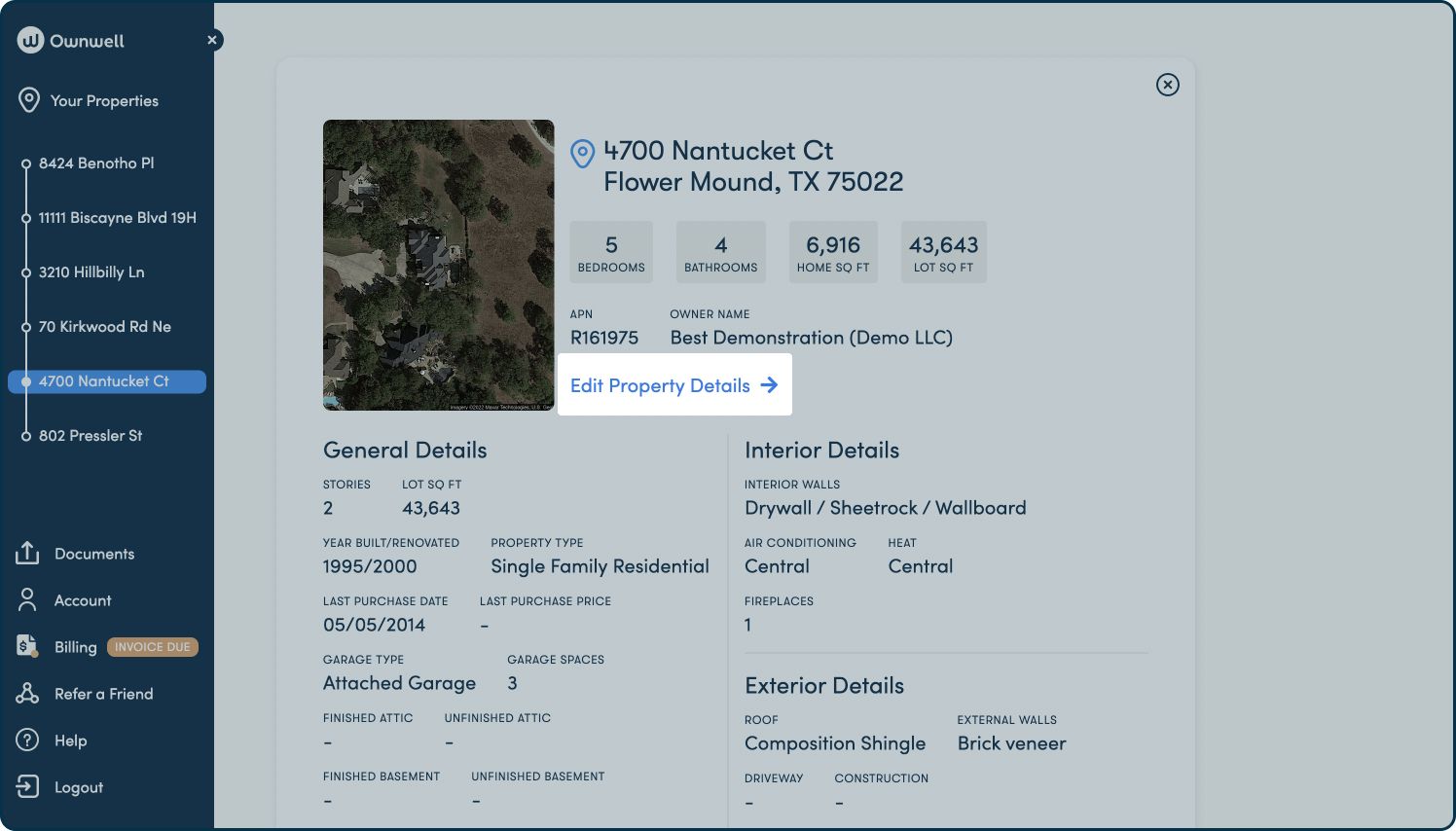

At the top of the individual property dashboard, you’ll see a summary of your property details. Select “View More Details” in the bottom right corner to expand this section.

-

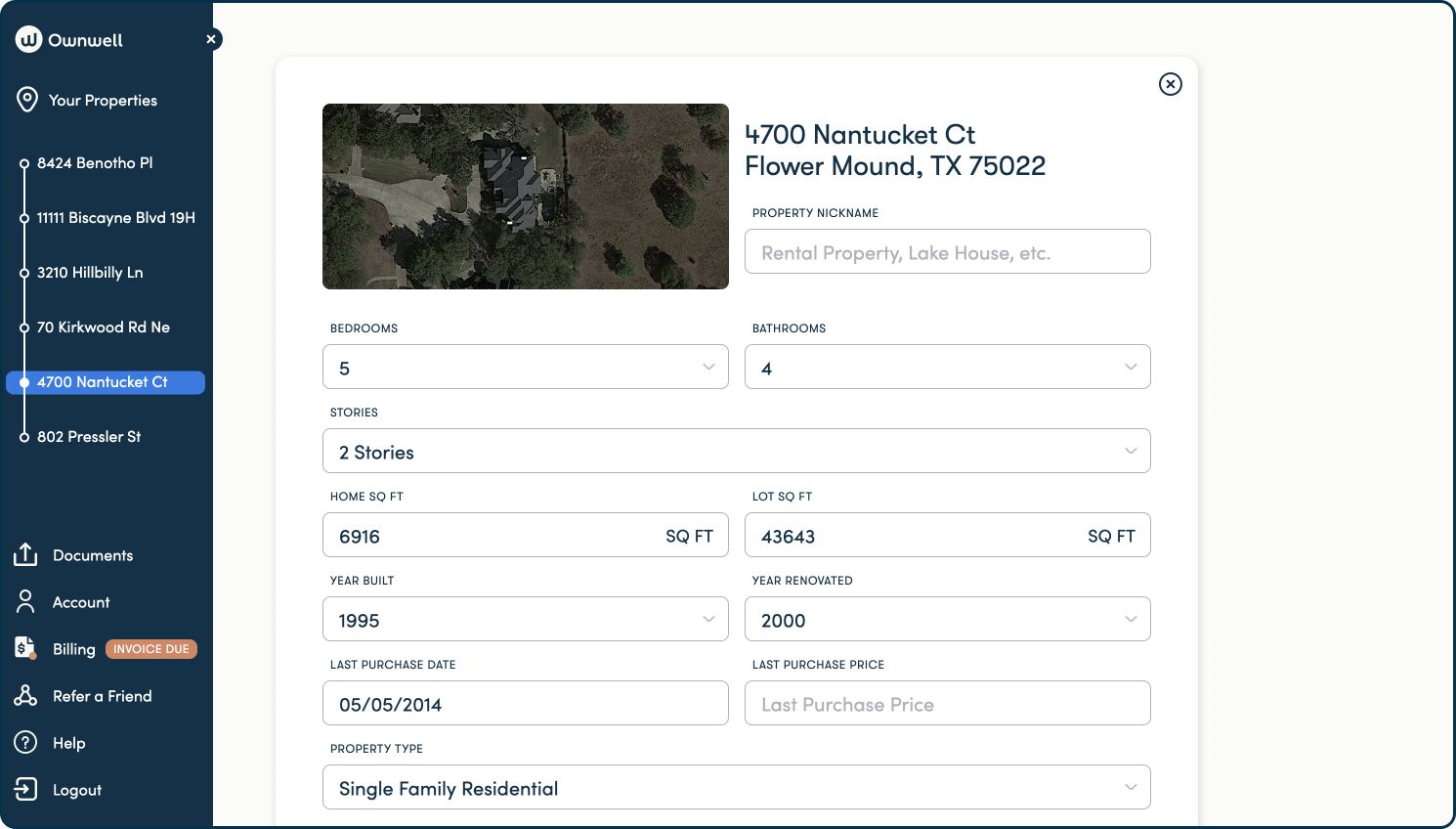

To continue to edit or add details, click “Edit Property Details” and make any changes or additions you’d like.

- Make sure to save the changes by clicking “Save Changes” at the bottom of this page.

How do I complete the annual property survey?

My account says information required or needs attention. What does that mean?

Can't Find What You're Looking For?

The Ownwell team is here to help.